Poshmark Fees & Taxes Explained

Poshmark is a great side hustle to earn extra income in this post we discuss the Poshmark fees involved with selling on the platform along with Poshmark taxes.

Poshmark Fees

Unlike eBay, Poshmark is free to list items. Once an item sells, items that have a sales price under $15 there is a flat fee of $2.95. For Sales over $15, Poshmark takes a 20% commission.

Examples.

- You list a shirt for $25 and receive an offer of $14. You except the Offer, your expected earnings on the sale will be $11.05. ($14-$2.95=$11.05)

- You list a handbag for $125 and receive an offer of $100. You except the Offer, your expected earnings on the sale will be $80. ($100×80%= $80 (100%-20%=80%)

Poshmark Fees Review

Shipping Cost is paid by the buyer unless you provide a discount.

Learn To Ship on Poshmark

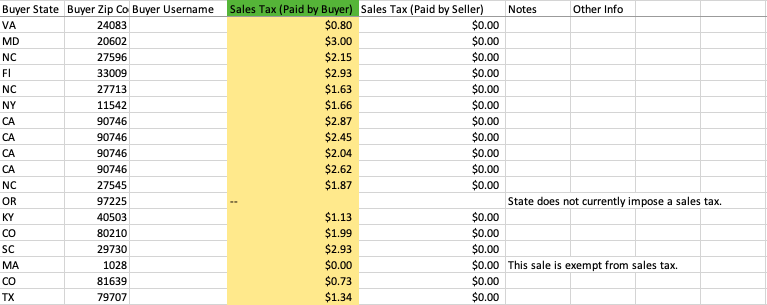

Poshmark Taxes

In 2019 Poshmark began to take sales tax on all sales on the platform except in the following states Florida, Georgia, Hawaii, Illinois, Kansas, Missouri, Tennessee, and Utah.

Items which are taxable on Poshmark

Used Items

Boutique Items

Wholesale Items

How Poshmark Sales Tax is Calculated

The Sales tax is based on the buyer’s delivery address.

- Type of item purchased

- Buyer’s delivery address

- Seller’s return address

- Shipping costs

Do I need to Claim my Poshmark Earnings on my Tax Return?

Technically, Yes.

If you were to become audited by the IRS and they saw frequent deposits to your bank account from Poshmark and the income was not reported on your yearly tax returns you will be held accountable for the taxes on those profits. Failure to report income can lead to many headaches. In the case of an audit, the IRS would charge interest on the taxes owed.

The taxes which are taken on each sale are strictly Sales Taxes only.

Businesses normally take care of the collection and reporting to their respective states. Poshmark is doing that part for you.

If you’re mainly selling clothing items that are from your closet or were donated to you, you’re at the hobby level. As you grow your closet and begin to purchase items to make a profit on and you have a track record on a personal banking account such as purchasing items from your local goodwill the IRS will consider this a business and expect profits reported. We recommend keeping a spreadsheet and all receipts of your purchases.

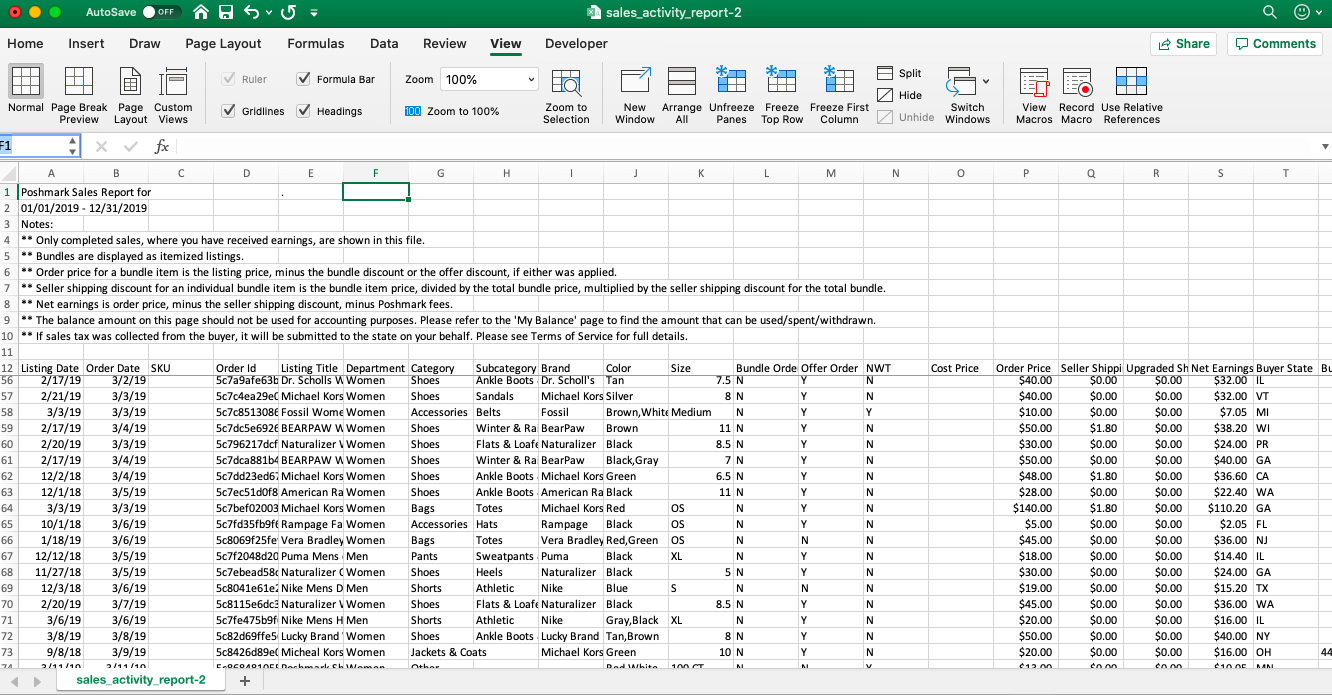

Tracking Poshmark Taxes

Poshmark allows its users to track sales and taxes on their My Sales Report. The sales report can be downloaded by visiting the settings drop-down on the upper right of your account and selecting My Sales. Midway down on the left side you will see My Sales Report.

Other Blog Post

Our blog is filled full of Poshmark Tips! Check out our other post to learn more!